June 25th, 2025

{ Engineering }

Tap. Save. Repeat: How dynamic add-cash pills personalize wealth building.

Ahmed Adegunle

At Cowrywise, we’re constantly exploring ways to make managing your finances more intuitive and human. Over the past few months, our team has been working on an exciting feature that blends data science with user experience to simplify saving.

We recently launched Dynamic Add Cash Pills: small, intelligent buttons within the app that suggest personalised top-up amounts unique to each customer. These pills show up across the app — on the Home, Save & Invest Screen — offering a quick, frictionless way to top up based on real customer behaviour.

What Makes This Feature Powerful?

The magic lies in how we combine several data-driven techniques.

Historical Transaction Analysis: We look at past savings & investment activities to understand the financial rhythm of each unique customer.

Descriptive Statistics: Key metrics like average inflows, typical top-up amounts (max/min), and frequency over the last 90 days help paint a detailed picture.

Customer Segmentation: We group customers based on distinct saving behaviours, allowing us to understand different customer segments.

Smart Recommendation Logic: An adaptive engine that uses insights from the analysis and segmentation to generate relevant top-up suggestions tailored specifically for each customer.

How Does It Look in Practice?

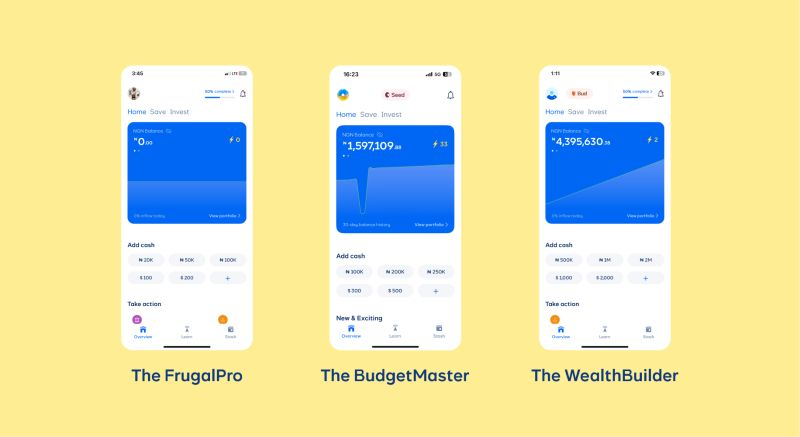

Every Cowrywise customer sees a unique set of “Add Cash” pills designed to match their habits and financial personality. Instead of a one-size-fits-all approach, the suggestions are tailored to each customer. The personalisations can be seen in the image below.

The FrugalPro: These suggestions are influenced by how new customers typically begin their wealth-building journey with pills like ₦20K, ₦50K, ₦100K for naira, and $100, $200 for dollars.

The BudgetMaster: This shows personalised top-up pills of ₦100K, ₦200K, ₦250K for naira, and $300, $500 for dollar based on wealth-building patterns identified by our system.

The WealthBuilder: A customer demonstrating a higher saving capacity. Based on their wealth-building pattern identified by our system, their suggested pills were ₦500K, ₦1M, ₦2M for naira, and $1000, $2000 for dollars.

This tailored experience makes it easier for each customer to take action, stay consistent, and build wealth effortlessly based on their specific financial context.

Why It Matters.

This feature isn’t just about convenience; it’s designed to have a real impact.

Reduces Decision Fatigue: It helps answer the common question: “How much should I save today?”

Stays Relevant: The recommendation engine refreshes its analysis periodically (currently analysing the most recent 90-day window monthly) to adapt to real-life changes.

At Cowrywise, we always build with a customers-first mindset. This is just the beginning of a smarter, more intuitive wealth-building experience.